Goodbaby International is a global leader in the baby products segment. With a portfolio of brands including Goodbaby (GB), Cybex, Evenflo, and others, it serves millions of families in China, Europe, and the USA. We consider the Cybex brand a hidden gem whose value is significantly underestimated. With a current valuation of forward EV/EBITDA ~2.6x and forward P/E ~5x, this is a deeply undervalued company with the potential for significant growth. We see the possibility of more than doubling the share price within a 12–24 month horizon.

Why we think GB trades at a low valuation:

Revenue and earnings remain highly volatile.

Perception gap: seen as "too Chinese" by Western investors, yet "not Chinese enough" in Asia.

Minimal sell-side coverage limits visibility.

Small-cap listed in Hong Kong, with low liquidity.

Operates in a saturated, highly competitive market.

Declining birth rates fuel a bearish industry narrative.

Legacy of high leverage, though balance sheet has improved.

Exposed to tariffs and geopolitical/macroeconomic headwinds.

Why we are long GB:

Extremely low valuation: The company trades at ~4.6x P/E and ~2.6x EV/EBITDA— levels that appear deeply discounted given its profitability, market leadership (by revenue, innovation, and patents), and broad geographic and product diversification.

Successful deleveraging - The balance sheet has significantly improved, as the reduction in debt lowered finance costs from HK$216 million to HK$155 million a decrease of approximately 28.2%. We expect this trend to continue in 2025, as the company is expected to generate strong cash flow.

Underfollowed company: Labeled a "Chinese stock" even though the vast majority of its revenue comes from outside China. Minimal analyst coverage.

Significant improvement in financial performance.

Weak HKD: About 43% of revenue comes from EMEIA, with much of it in euros. For European investors, a strong euro means better HKD conversion when buying the stock. For the company, euro-denominated revenue translates into higher reported sales and earnings in HKD.

Hidden gem in the Cybex brand: Cybex is a strong brand with premium positioning. By exiting the low-margin segment, it has structurally improved profitability—a trend we expect to continue as pricing power and brand equity strengthen.

Dual-Segment positioning.

Changing consumer behavior trends that favors Goodbaby.

Social trends data as a tailwind.

Significant insider ownership.

“China call option” for free: China business is supposedly loss-making, but the rest of the company is profitable. A turnaround in China could boost earnings, while failure wouldn’t threaten the group’s stability.

We will support our views in more detail further down. But let’s start with the core business overview...

Business overview

Products & Segments: Two major segments – strollers and accessories, car seats and accessories, and two minor segments – non-durable products (clothing, textiles, feeding and care items), and others (e.g., bicycles, toys).

Main brands: Goodbaby, Cybex, Evenflo (US).

Vertical integration: In-house development, manufacturing, and distribution ensure greater control over quality and costs. The 2024 annual report confirms growing profitability (EBIT margin 5.5%).

Top-tier R&D and design: Multiple Red Dot, German Design, TIME magazine award, and NAPPA Awards confirm its innovative strength.

Financials breakdown

Key results for 2024 vs 2023

Revenue breakdown by geography (FY 2024)

Revenue performance for Q1 2025

*The reason for Evenflo’s revenue decline is unclear, especially given strong Q1 demand. It likely reflects timing shifts in partner orders or temporary pricing pressure from discounting. Volatility between quarters is expected.

**After five years of decline, the Blue Chip and Other Business segment returned to growth in 2024 and is up 40% YoY in Q1 2025. While the near-term financial impact is modest, the trend is strategically meaningful. If sustained, it suggests: (a) increasing demand for Goodbaby’s manufacturing expertise, (b) rising factory utilization and scale efficiency, (c) greater control over industry supply chains, and (d) enhanced visibility into market trends beyond its own brands.

Revenue breakdown by brand

Charts shows China’s revenue contribution is declining, but this is being more than offset by steady growth in other regions. Modest international expansion continues to outpace the contraction in China.

If the China segment stabilizes, it could (a) renew interest from Chinese investors and (b) improve overall profitability, as the region is likely loss-making.

Goodbaby’s domestic own-brand business is expected to bottom out in 2025. The core issue behind its multi-year decline has been channel-related—something now openly acknowledged by Chairman Song. In response, the company has launched a broad restructuring of its China operations: replacing the local leadership team, shifting livestream operations in-house, partnering with a professional marketing agency, and opening a dedicated livestream base. These moves reflect a clear strategic commitment to stabilizing and reviving domestic performance.

While China’s declining birth rate remains a structural headwind, the market for quality children's products remains sizable. According to the Sullivan Report, annual sales of strollers and car seats in China total ~RMB 30 billion, with ~RMB 10 billion attributable to branded products (excluding low-end white-label offerings).

In sum, while the China segment has been a drag on performance, there is a credible path to stabilization—and potential for long-term recovery.

A glimpse into history: to understand low valuation

We wanted to highlight key events that help explain why Goodbaby International trades at depressed valuation levels today, despite improvements in its fundamentals.

Goodbaby IPO

Goodbaby International (HKEX: 1086) went public in late 2010 at around HK$4.9 per share. Over the following years, investor optimism around global expansion and acquisitions helped the stock remain in the HK$4–6 range, with the share price still trading near HK$5 as late as 2017.

The 2018 Collapse

In December 2018, Goodbaby issued a profit warning, and investor sentiment quickly turned negative. The share price collapsed within weeks, driven by a convergence of structural headwinds:

Falling birth rates and weaker consumer sentiment in China:

In 2018, China recorded a ~12% decline in births, directly impacting demand for juvenile products. On top of that, weakening consumer confidence during the second half of the year further dragged on domestic sales. Although Goodbaby managed to maintain stable revenue in China, it came under significant pressure.Export market disruption, notably in the U.S.:

Trade tensions and macro uncertainty weighed on demand in Western markets. Critically, the bankruptcy of Toys “R” Us and Babies “R” Us in the U.S. eliminated a major distribution channel. Sales through TRU/BRU fell from HK$291.6 million in 2017 to just HK$34.6 million in 2018, and Goodbaby had to write off bad debts related to the closure. The shock forced the company to rapidly restructure its North American distribution model, particularly impacting its Evenflo division.Integration and restructuring costs:

Goodbaby was also still digesting earlier acquisitions (Cybex, Evenflo, and its China retail operations). Restructuring, operational consolidation, and distribution realignment led to one-time costs that temporarily compressed margins.Intense competitive pressure:

Globally, the juvenile products sector became increasingly competitive. Rivals such as Dorel (Safety 1st, Maxi-Cosi), Britax, and emerging brands pushed harder on pricing and innovation. Goodbaby had to increase R&D and marketing spend just to stay competitive, further weighing on margins amid flat revenue.

As a result of these combined pressures, investor confidence collapsed, and Goodbaby’s share price fell from HK$4–5 to below HK$1 by early 2019—a decline of over 75%. This remains the sharpest and most concentrated drawdown in the company’s history.

The memory of this event—compounded by the company’s listing on the relatively underfollowed HKEX—continues to weigh on sentiment, despite the material improvements in profitability, brand strength, and strategic clarity achieved since then.

Recovery measures

Following the sharp collapse in 2018, Goodbaby’s shares remained depressed, mostly trading below HK$1.5 throughout 2019. The COVID-19 shock in early 2020 triggered another short-term dip, but the company proved resilient—sales recovered in H2 2020, and net profit grew year-over-year, supporting a modest rebound in the stock price.

In 2021–2022, Goodbaby hit record revenues—driven by post-COVID demand in some markets and the success of new product launches. However, this was offset by persistent headwinds: a continuing decline in China’s birth rate (down 12% YoY in 2021), rising input costs, global supply chain issues, and renewed lockdowns in China. Profitability weakened, leading to a profit warning in early 2023, which pressured the share price once again.

Present

At the start of 2023, Goodbaby hit a multi-year low of ~HK$0.47. Since then, however, the trend has reversed. Between 2023 and mid-2024, the stock staged a strong recovery, reaching a local high of HK$1.55 by March 2025—an increase of over 200% from its 52-week low. Still, over a 5-year horizon, long-term shareholders remain deep in the red, with cumulative losses of ~78% since 2017.

As of June 2025, Goodbaby’s market cap stands at approximately HK$1.9–2.0 billion, basically classifying it as a small-cap “penny stock” on the HKEX. The shares remain volatile and sensitive to earnings momentum and market sentiment. However, operational metrics are improving—EBIT margin expanded from 3.0% to 5.5% over the past year. Management has expressed cautious optimism, supported by forecasted revenue growth of 11% in the coming year.

The question is… can it warrant a higher valuation? Let’s dig deeper.

Underfollowed stock

Notably, HKEX Southbound Connect holdings remain below 1%. Such a low level of participation suggests limited retail and institutional interest from the mainland. This may reflect either lack of awareness or negative sentiment toward the company.

A reversal in China performance could potentially trigger a re-rating, particularly if Southbound flows begin to increase.

A selected chinese forum comment (translated) reflects the domestic sentiment:

“Went to the physical store to have a look. I stayed near the physical store for an hour. There were customers of GoodBaby, but not many. I looked carefully at its products, which were similar to those in the online flagship store. The basic products were safety seats, strollers, and some maternal and child products. I basically had no demand for them. After some calculations, based on GB's product categories and combined with the product situations of Babycare and October Crystal that I have observed, it seems that GB does not understand the sinking market and will not launch any new products. The new products are estimated to have no price competitiveness. GB sold 175 million in the first quarter, and it is estimated that it will be difficult to improve in the second quarter of this year. Then we can only pin our hopes on Cybex and Evenflo, but these two products are not easy to keep an eye on. We can only search for information about their sales online.”

Low interest from Asian investors is largely due to the dominance of the Goodbaby (GB) brand in the region, which local consumers view as conventional and undifferentiated. In China, GB faces intense competition and lacks premium positioning.

This domestic underperformance likely colors investor perception, even though it doesn’t reflect the trajectory of Evenflo and Cybex outside of China —both modern, innovation-led brands with strong momentum in Western markets. Recent product launches (see Evenflo [link] and Cybex [link]) underscore their global relevance.

Conversely, Western investors often dismiss the stock as “just another Chinese company.”

This disconnect on both sides has created a pricing inefficiency—and a compelling opportunity.

Goodbaby’s excellent positioning in stroller market

Dual-segment

Goodbaby International has a strong position in both the premium and value segments of the stroller market. Its brand portfolio includes Cybex (premium) and Goodbaby and Evenflo (more affordable options), allowing it to cover a wide range of price points. This gives the company a major advantage in pricing, marketing, and adapting to demand.

It can target different types of parents—from cost-conscious buyers to those willing to pay more for safety, design, or new features.

By being active in all segments, the company gets useful insights into consumer behavior at different price levels. This helps with smart pricing—raising margins on premium models when demand is strong, or using discounts on lower-priced products to win market share.

It also supports cross-selling and upselling. For example, a parent might start with an affordable Evenflo stroller and later upgrade to Cybex.

Economies of scale and operating leverage

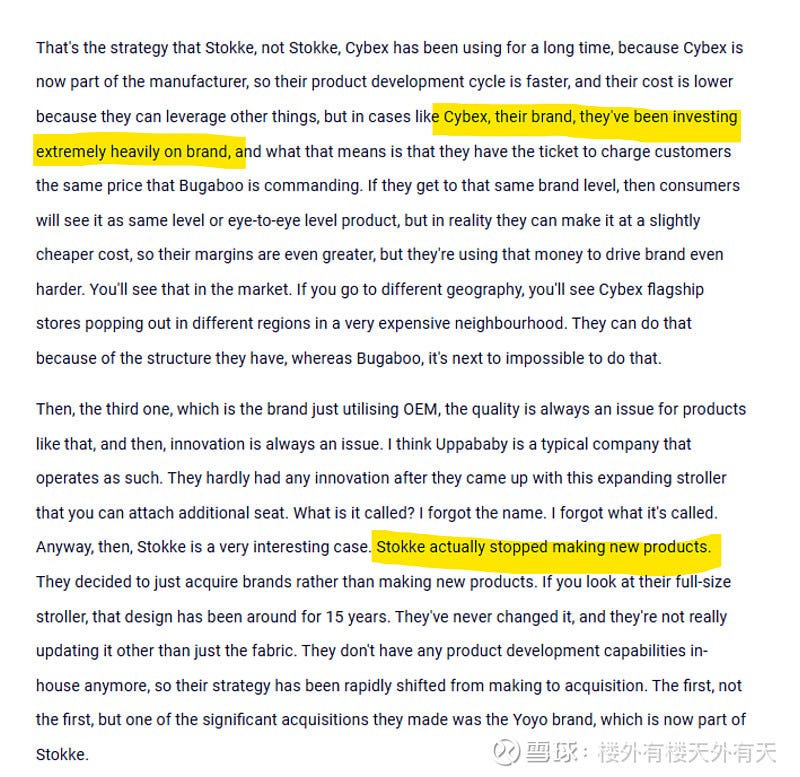

Martin Poš (CYBEX founder) provided an excellent interview discussing his approach to scaling (translated):

“You know how many Louis Vuitton boutiques there are? Five thousand five hundred. And do you know why that’s great? Because it’s independent. And right now we’re still dependent on someone. I’m not satisfied with that, so I’m eliminating those dependencies. I was dependent on manufacturing, so I partnered with Goodbaby. I was dependent on engineers, so I partnered with them.

Distributors were destroying my brand, so I either bought them or built my own distribution. And now we’re one step further. Then it turned out that luxury boutiques didn’t exist, so we build them ourselves. That’s why we opened stores in Tokyo, China, and finally here in Prague. Is there a Louis Vuitton somewhere? Then we open a store right next to it.”

Martin Poš has essentially confirmed that the company’s self-operated stores are not only viable but also profitable—so they’ve started scaling them. This marks a shift toward greater independence in distribution.

That same theme of independence is also visible on the manufacturing side. Goodbaby International owns large-scale production facilities in China, Mexico, and the U.S., which gives it a strategic edge through economies of scale and operational leverage. Because the company is vertically integrated—from design to final assembly—it retains full control over product quality, innovation, and cost structure.

A comment on Chinese social media captures this competitive advantage aswell (source):

With annual revenue exceeding HK$8 billion, Goodbaby can efficiently spread its fixed costs (such as wages, mold development, and R&D) across high production volumes, which reduces unit costs. Its scale also enables it to negotiate better terms with suppliers of key inputs like plastics, aluminum, and textile components.

These factors allow Goodbaby to achieve higher margins during periods of growing demand. Since many costs remain fixed, EBITDA increases faster than revenue—a classic sign of strong operating leverage.

Narratives in segment as a tailwind

1. More than one stroller for one child

Modern parents increasingly purchase multiple strollers per child, typically combining different models for various use cases—e.g., a bassinet for newborns, a sport stroller for toddlers, and a compact model for travel or city use.

This multi-stroller trend is supported by earlier data: a 2013 U.S. survey found that 77% of parents with children under four owned more than one stroller, with 21% owning three or more, and 8% owning over four. While availability of fresh global data is limited, anecdotal evidence suggests the trend has persisted, driven by lifestyle needs and product specialization.

2. Rising expenditure on strollers

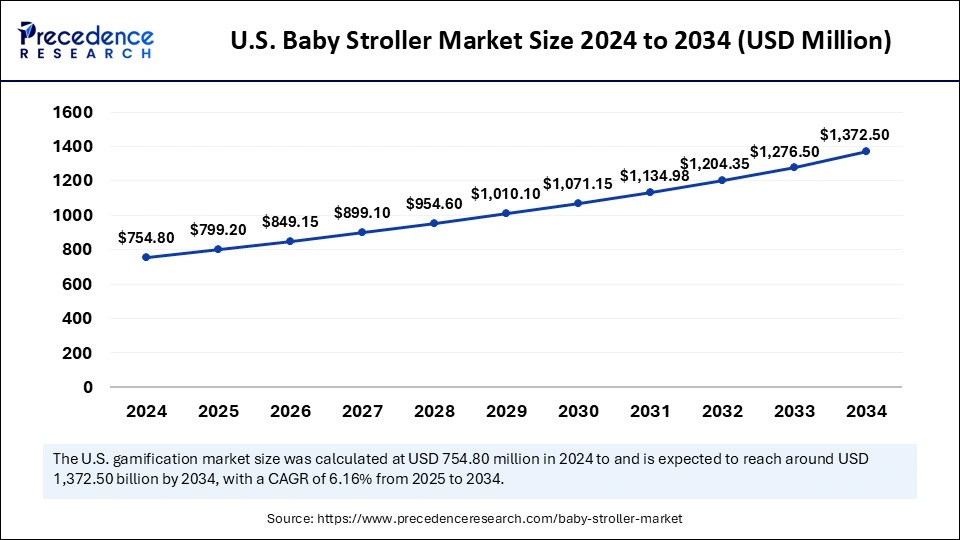

Over the past decade, there has been a clear trend toward higher spending on strollers, with average selling prices steadily rising. Despite flat or declining birth rates in many markets, the global stroller market continues to grow in value — indicating increased spending per child.

According to Precedence Research, the global stroller market is expected to expand from ~$2.72 billion in 2024 to $4.88 billion by 2034, reflecting a CAGR of ~5–6%. In the U.S., the market is projected to grow from $754.8 million in 2024 to ~$1.37 billion by 2034, a CAGR of 6.16%.

Parents today are spending more on strollers and are increasingly choosing premium, branded models. For many families, including middle- and even lower-income households, the relatively higher cost is justified by the added safety, comfort, and time-saving features.

Moreover, strollers are no longer seen as just practical items—they’ve become reflections of lifestyle, personal style and even as a luxury showcase. It’s no longer unusual to see higher-priced strollers in households that wouldn’t traditionally be considered luxury buyers.

As a result, the total addressable market for premium and luxury strollers is much larger than it might appear at first glance.

3. New or used?

Although the second-hand market for baby products has expanded, especially through online platforms, most parents still prefer to buy new when it comes to key safety-related items like strollers and car seats. According to a national survey by C.S. Mott Children’s Hospital, while 53% of parents reported using some pre-owned baby gear, only 17% used a second-hand stroller, and just 7% used a pre-owned infant car seat—the lowest among all categories. This reflects heightened concern about safety, reliability, and product history.

In fact, 74% of parents said they prefer to buy new equipment to ensure it is safe, and 63% find it difficult to assess the safety of used gear.

The strong preference for new strollers and car seats is driven by several key factors:

Safety & reliability: New products meet current safety standards, include a warranty, and eliminate concerns over hidden damage, past recalls, or degraded components.

Hygiene: These products come into close contact with the child. New units offer guaranteed cleanliness—free from allergens, stains, or prior use—which is especially important to health-conscious parents.

Modern features: New strollers and car seats often include updated technology like lightweight frames, better suspension, car seat compatibility, or app-based monitoring.

Design & style: Parents—especially first-timers—often value the aesthetics of current models, treating them as both practical items and lifestyle accessories.

Emotional value: The purchase of a stroller or car seat marks a key milestone in preparing for a child. Many parents want the satisfaction of buying new and providing the best for their baby.

Together, these factors help maintain strong demand for new strollers, even in a growing resale economy.

4. “Snowball effect”

In the stroller market, popularity often grows on its own—like a snowball rolling downhill. When parents see the same stroller brand used by others around them, they’re more likely to buy it too. This is known as a network effect or snowball effect, and it’s driven by several factors:

Social influence: Parents feel more confident choosing a stroller they often see at parks, cafés, or on the street. If many others use it, it must be a good and trusted choice.

Style and community: Strollers are not just practical—they’re part of a parent’s image. A popular model can signal taste, status, and a sense of belonging to a group of “modern” parents.

Word of mouth: Many parents look for advice in online (mom) forums, parenting groups, or social media (tiktok). Honest reviews and recommendations from other moms often have more impact than ads.

Stronger brand over time: When a brand is trusted and parents are happy with it, more people talk about it and more people buy it. The brand becomes even stronger without needing extra advertising.

Every stroller seen on the street or mentioned online helps spread awareness and builds trust, making more parents choose them over time.

5. Car seats in addition to strollers

Car seats make up a big share of Goodbaby’s revenue, and most trends seen in strollers also apply here—especially the shift toward quality and premium brands.

Many families own more than one car seat, either for multiple cars or as the child grows.

Safety matters more than ever—parents prefer to buy new, since used seats can be damaged, outdated, or unsafe.

New models offer better protection, with features like side-impact systems, airbags, and easier installation.

Prices are rising faster than strollers, due to stricter safety rules and new tech.

Parents are more willing to invest in trusted, modern car seats, making this a strong and growing part of the business.

Social trend data as a tailwind

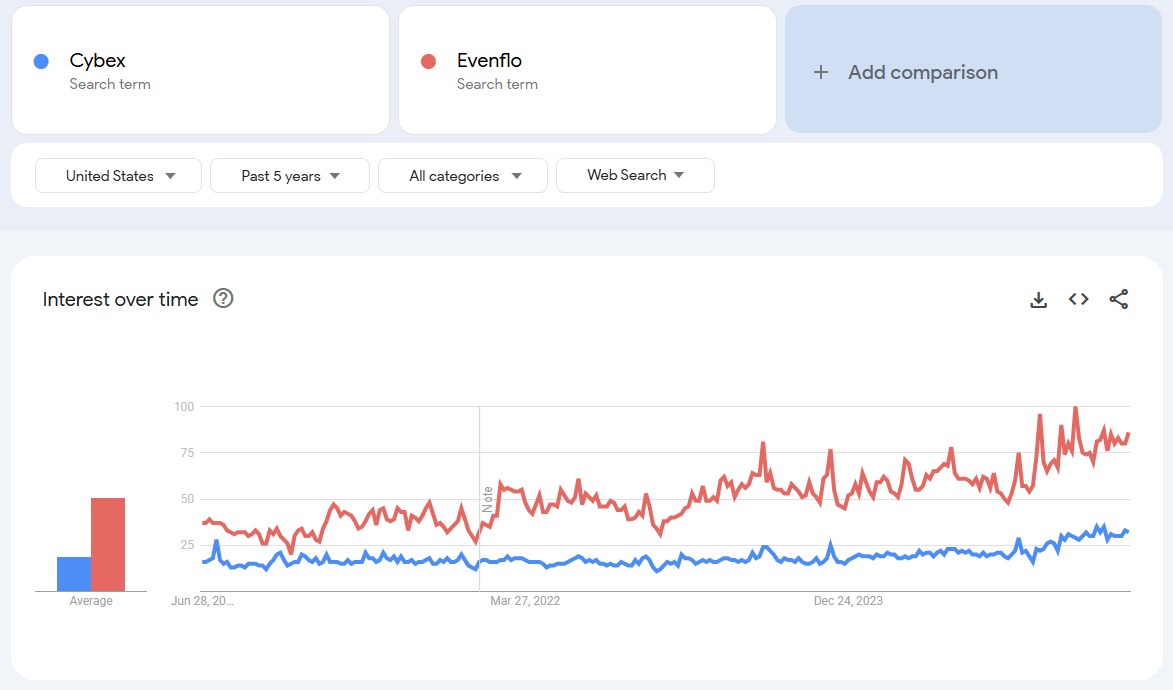

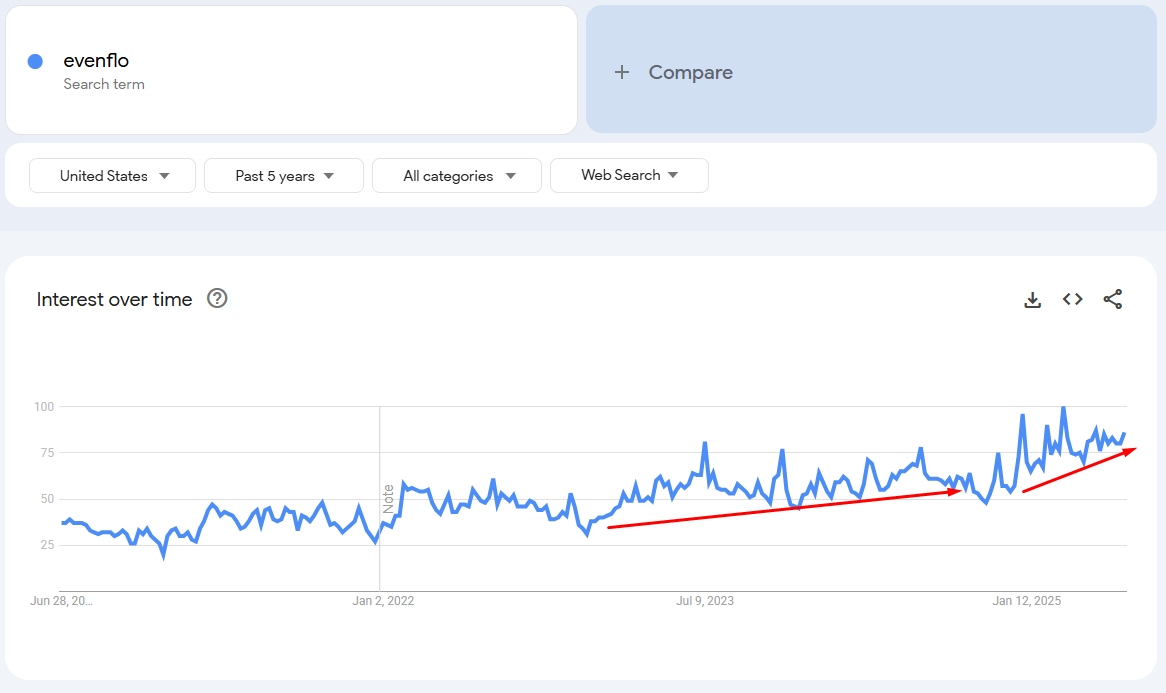

Social-media and search trends are our best early read on demand. When Google searches for Cybex or Evenflo jump and stroller videos start trending on Instagram and TikTok, store sales usually follow. Because these signals show up in real time—weeks before wholesalers report orders—they help us catch turning points sooner.

Google trends

Cybex and Evenflo brand search interest in the USA (past 5 years):

Cybex brand search interest in the USA (past 12 months):

Cybex brand search interest in the USA (past 5 years):

Cybex stroller and car seat search interest in the USA (past 5 years):

Cybex stroller and car seat search interest worldwide (past 5 years):

Evenflo brand search interest in the USA (past 12 months):

Evenflo brand search interest in the USA (past 5 years):

Evenflo stroller and car seat search interest in the USA (past 5 years):

Amazon data

The Amazon charts below echo the social signals, with Cybex and Evenflo search counts and bestseller-rank curves climbing week after week—hard, point-of-sale data that typically turns into sell-through within a quarter.

Amazon US Search volume for the Cybex brand YoY:

April YoY: ~+27%

May YoY: ~+25%

June YoY: ~+17%

Amazon US Search volume for the Evenflo brand YoY:

April YoY: ~+49%

May YoY: ~+38%

June YoY: ~+36%

Social media anecdotal data

Views of #Cybex and #Evenflo stroller clips helps keep the snowball rolling, and the platform’s peer-driven, short-form videos make it the ideal place for parents to trade real-world baby-gear experiences.

Every day, tens of new baby-gear videos pop up, including Cybex and Evenflo products, and many rack up thousands of views and likes within hours or days, keeping the brands constantly in front of young families.

Cybex: Untapped global potential

Cybex’s brand penetration outside of Europe remains a fraction of what it achieves within European markets. Based on an analysis of Google search interest data, we estimate that if Cybex were to reach the average level of brand penetration seen in Europe outside of Europe, especially US, its revenues could increase sixfold.

If it were to match the brand strength achieved in leading markets like France, Germany, Poland, or the Czech Republic, total revenues could rise by more than 12x compared to current levels.

We are not suggesting this level of growth is imminent. Rather, the goal is to highlight the brand’s long-term potential if it manages to replicate its European success in larger, underpenetrated international markets.

To illustrate, based on Google trends data, Slovakia—assigned a value of 100—means Cybex is twice as popular there as in Latvia and some 16× more popular than in the U.S. That index correlates roughly with market share. Yet beyond Europe, there remain dozens of countries with populations over 10 million where Cybex’s penetration is in the low single digits (full table at the end1 ).

In our calculation about 82.5 % of the global population falls into the lowest google data interest demographic.

Bottom line: there are many big countries where almost nobody knows Cybex yet. If brand awareness in those places climbed up to European levels, the company could unlock a huge increase in revenue.

Undervalued in a comparison to an acquired peer?

In July 2024, Mubadala Capital (Abu Dhabi's sovereign wealth fund) announced the acquisition of a majority stake in Bugaboo from Bain Capital. Although the deal value wasn’t officially disclosed, the Financial Times reported a valuation in the range of £300–400 million (~€350–450 million). Mubadala also secured a €300 million loan to fund the transaction, further supporting this valuation range. Bugaboo's 2023 revenue was approximately €233 million, implying a valuation multiple of ~1.5–2x revenue.

Now consider Goodbaby:

Goodbaby’s revenue is more than three times higher than Bugaboo’s

Yet its current market cap is less than half the estimated value of the Bugaboo deal

Google Trends data shows that Cybex alone has more than double Bugaboo’s global search volume

Combined, Cybex + Evenflo show over 3x Bugaboo’s search interest

If Bugaboo—smaller in both revenue and brand visibility—can command a valuation of €350–450 million, then Goodbaby appears significantly undervalued by comparison. This valuation gap highlights a strong disconnect between brand strength, scale, and market pricing, presenting a clear upside opportunity.

Committed management and insiders

Goodbaby International has strong insider ownership, with over 50% of shares held by founders and key executives. The largest stake belongs to Song Zhenghuan, the company’s founder and Chairman, who—together with his family—owns approximately 46% of the company. Martin Poš, Executive Director and founder of CYBEX, holds around 5.3%, while CEO Liu Tongyou owns about 1.7%.

Such significant insider stakes reduce the risk of short-term decision-making and signal confidence in the company’s future.

Goodbaby management team consists of skilled and experienced executives.

Song Zhenghuan – Founder & Chairman

Song is the founder and long-time leader of Goodbaby. He developed the company’s first stroller in the 1980s and expanded the business into a global group through innovation, international expansion, and key acquisitions such as CYBEX. As Chairman and largest shareholder, he continues to guide long-term strategy and governance.

Martin Poš – Executive Director & CYBEX Founder

Martin founded CYBEX and joined Goodbaby after its acquisition in 2014. As former Group CEO and now Executive Chairman of CYBEX, he has driven the company’s premium brand strategy through design, innovation, and global marketing. His influence remains central to Goodbaby’s positioning as a lifestyle-oriented brand group. (For those interested, here’s great insights from Martin Poš in czech language: Forbes1 and Forbes2.)

Roland Auschel – Chief Sales Officer, CYBEX

Roland joined Cybex after 33 years at Adidas, where he was Sales Director. He oversees all of Cybex’s sales channels worldwide. Roland’s goals are to grow Cybex’s partnerships with retailers, build a sales team tailored to each region, and lead the sales organization through its next phase of global expansion.

Liu Tongyou – Group CEO

Liu has been with Goodbaby since the 1990s, previously serving as CFO before becoming CEO in 2023. Known for his operational discipline and financial expertise, Liu has led the company’s return to profitability and margin improvement through stronger cost control and strategic focus.

Michael Nan Qu – CEO of Evenflo & Head of Americas

Michael has played a key role in Goodbaby’s global growth, especially in North America. He successfully managed U.S. operations during major disruptions, including the Toys “R” Us collapse, and led a shift toward stronger distribution and retail partnerships in the region.

Sharon Nan Kobler – CEO of gb Brand & China Market

Sharon built Goodbaby’s e-commerce and digital sales channels from the ground up and now leads the gb brand in China. She focuses on digital marketing, product localization, and adapting to shifting consumer trends in the highly competitive domestic market.

Risks

Several risks need to be considered:

Tariffs

The U.S. remains heavily reliant on Chinese imports for juvenile products:

Approximately 97% of strollers and 87% of car seats sold in the U.S. are sourced from China.

We estimate that the U.S. accounts for roughly 20–25% of Goodbaby’s total revenue, making it an important market but not a single-point risk.

Compared to peers, Goodbaby is better positioned to navigate tariff challenges:

As one of the largest buyers of raw materials, it secures favorable terms from suppliers.

It operates factories in the U.S. and Mexico, offering partial insulation from tariffs.

The company previously benefited from Section 301 tariff exemptions, which are again under discussion amid industry pressure.

Importantly, baby gear like strollers and car seats is not discretionary—it’s essential. As highlighted in recent reporting by Axios, these products are critical to family planning and early child safety, making the segment especially sensitive to price volatility. Industry voices and some policymakers are now pushing to reintroduce tariff exemptions for these categories.

Given this context, we believe that at the current market price (HK$1.05), the tariff-related downside is more than fully priced in. Any policy shift—such as the reinstatement of exclusions—would likely serve as a positive catalyst. As such, we see tariffs as a source of optionality, not just a risk, in Goodbaby’s investment case.

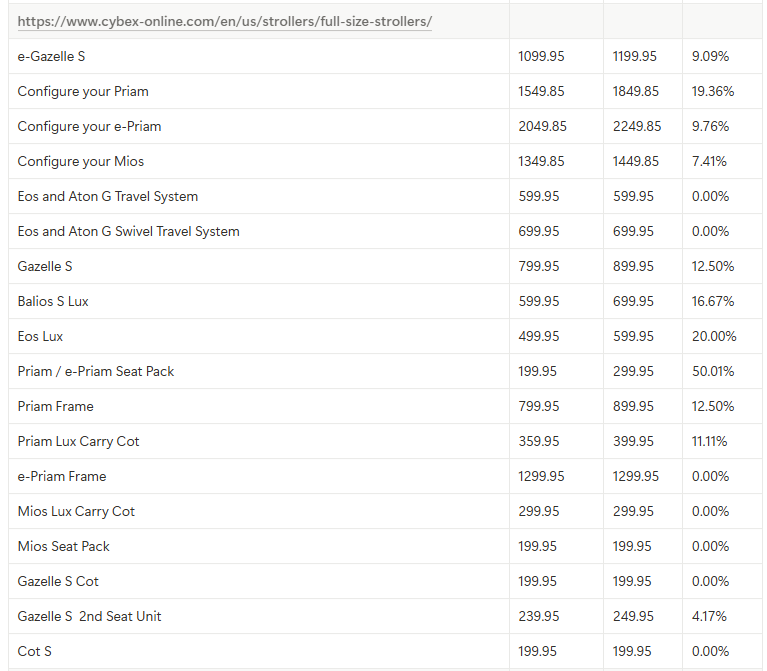

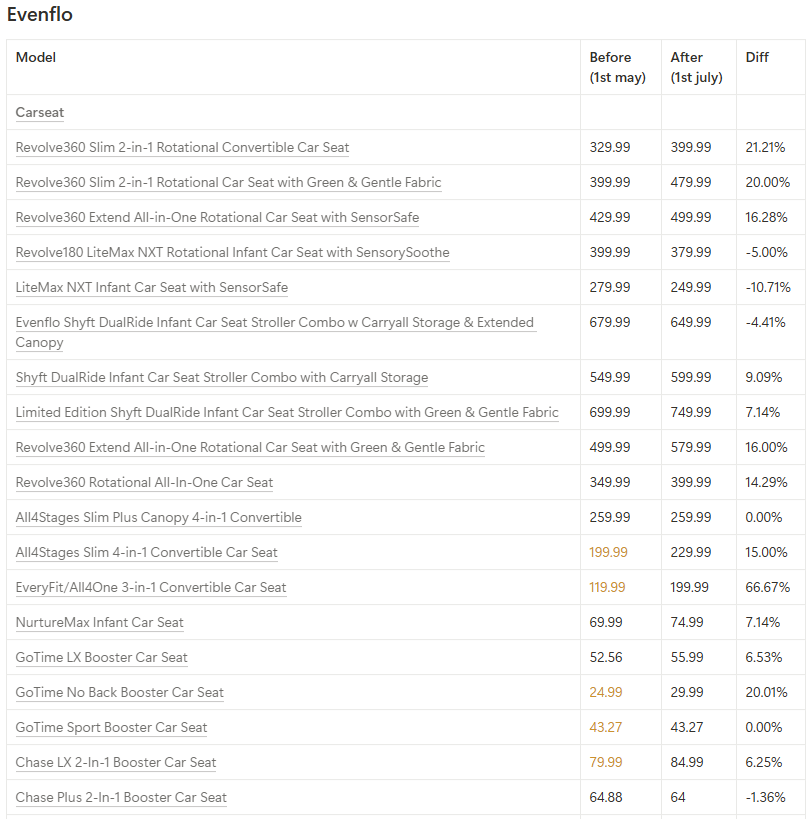

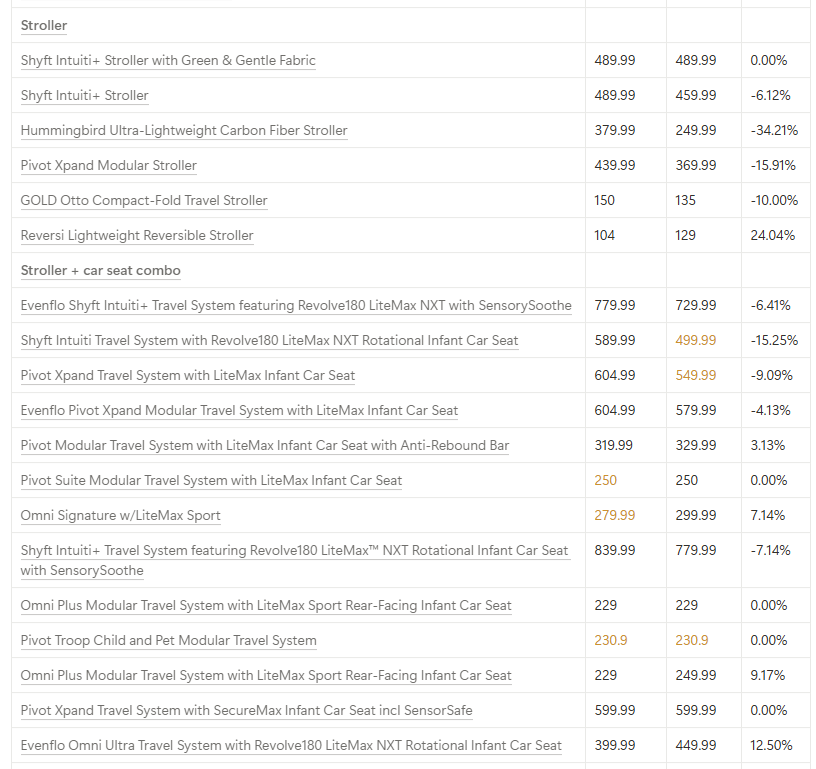

In response to rising tariff pressure, in our observation, Cybex increased prices by an average of 12% and Evenflo by 6.6%, effective May 1, 2025. (Full table at the end2)

Other risks

Reduced Consumer Demand: As the flagship is the premium brand Cybex, in case of an economic downturn, consumers may prefer cheaper products.

Competition: The baby products segment is highly competitive. Although the company currently has a strong position, it does not automatically mean that success will continue.

Management: Weaker execution by management, or an inability to attract sufficient talent (e.g., failures in launching new products or implementing strategy), represent further potential threats.

Low Birth Rates: Although Goodbaby can continue to gain market share and we believe that premiumization and market share growth more than compensate for the decline in birth rates, a potential acceleration of this negative trend reduces the company's growth potential.

Supply Chain, Increased Input Costs: Disruptions in the supply chain or a potential increase in material prices can significantly affect profitability, both positively and negatively.

Hong Kong listing and low visibility: The stock may continue to trade at depressed multiples due to limited investor attention on the HKEX and a story that lacks immediate appeal.

Our Goodbaby financials projections (2024-2027)

For the years 2026 and 2027, we are modeling growth in both margin and net income. This is based on the following assumptions:

We expect Goodbaby will successfully manage the tariffs,

A significant reduction in debt and cheaper financing will lower financial costs, and

The decline in China will stabilize in 2025, with the market returning to modest growth in the low single digits in 2026 and 2027.

In addition, we assume that the total dividend payout for the years 2025, 2026, and 2027 will reach HKD 0.25.

Conclusion

At ~4.6 × forward earnings and 2.6 × EV/EBITDA, Goodbaby is priced like a no-growth cyclical even after net profit jumped 71 % on just 11 % revenue growth last year. Brand momentum is unmistakable: U.S. Google- and Amazon-based interest in Cybex is roughly 45 % higher year-on-year, while the brand’s penetration outside its European stronghold remains only a fraction of that base. A two-tier portfolio spanning premium Cybex and value-oriented Evenflo/GB lets the company flex pricing and channel strategy as demand shifts—an agility most peers lack. With insiders owning about 53 % of the equity and any U.S. tariff-exclusion reinstatement still unpriced, the risk-reward profile remains decidedly attractive.

Disclaimer:

The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in this publication are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. The information used in this publication is from sources that are believed to be reliable but the accuracy cannot be guaranteed. It may include some errors, please make sure to do your due diligence.

The author may own shares in company mentioned in this article as of 7 July 2025. The security could be sold at any point in time without prior notice.

Notes:

Really god job guys