Wakuku: new Labubu contender?

Labubu took the world by storm—from kids with plushies to their grandmas unboxing on TikTok and celebrity endorsements everywhere. But amid the hype, one real rival stands out: Wakuku.

Disclaimer

The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in this publication are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. The information used in this publication is from sources that are believed to be reliable but the accuracy cannot be guaranteed. It may include some errors, please make sure to do your due diligence.

A new cultural IP trend—Wakuku—is gaining explosive traction in China’s blind-box market, and early data suggests it may become the next Labubu-style phenomenon. There might be some hurdles on the way, so we consider this a risky opportunity. Key public equity beneficiaries are Quantasing (QSG) and Miniso (MNSO).

Why it matters

China’s trendy toy market is booming—and far from saturated. According to a 2024 report by the Chinese Academy of Social Sciences, the industry was worth 60 billion yuan in 2023 and is projected to nearly double to 110.1 billion yuan by 2026.

Even Pop Mart, the dominant player behind the Labubu craze, held only about 10.5% market share in 2023, with revenue of 6.3 billion yuan. That leaves plenty of room for new IPs to gain traction—and Wakuku is emerging as one of the strongest contenders.

What is Wakuku?

Wakuku is a collectible toy IP developed by Letsvan, a company now majority-owned by QuantaSing Group (QSG)—a firm originally focused on online education.

Wakuku has quickly built a consumer presence—opening physical stores and scoring celebrity endorsements, including one from David Beckham. It’s also struck distribution deals with Miniso, giving the IP broad retail visibility across China.

While it took Labubu nine years to win over young Chinese customers, it barely took Wakuku a year.

The similarity goes beyond their names: the two figures look almost identical, and each comes with its own catchy song.

Wakuku has lifted PopMart’s entire marketing playbook—mystery blind boxes, viral drops, limited editions, livestream sales, celebrity endorsements and immersive store experiences.

Their expansion paths match too. Pop Mart’s first stop abroad was Thailand, and Wakuku chose the very same.

Wakuku’s real advantage is Labubu’s head start. By leaning into the same “ugly-cute” vibe—cheeky grin, wide eyes, crooked features and freckled cheeks—it taps the taste of young Chinese shoppers who prefer expressive, anti-perfectionist characters.

Early Signs: Wakuku vs. Labubu

From the anecdotal data we’ve tracked, Wakuku is shaping up to be the toy IP going head-to-head with Labubu.

On social networking platforms such as Xiaohongshu and Douyin, it is not difficult to find posts comparing Letsvan's IP "WAKUKU" with Pop Mart's LABUBU. "In the era of labubu, I'm chasing wakuku" has become a hot topic.

Wakuku’s Rise

While granular data from China’s toy market can be hard to come by, a series of high-impact events suggests Wakuku is gaining serious momentum among consumers—and fast.

March 29: Wakuku’s Chubby Elevator blind box launched at MINISO LAND Beijing Store No. 1, selling out in just 120 minutes. It became the second highest-selling launch day in the store’s history.

May 15: Wakuku ranked #8 on Taobao’s national blind box sales chart, indicating strong online traction in a highly competitive category.

May 17: The Fox & Bunny series dropped in MINISO LAND stores in Shanghai and Nanjing, breaking the Shanghai flagship’s single-day sales record, with over 1 million RMB in sales on launch day.

June 18: MINISO opened its flagship MINISO SPACE store in Deji Plaza—China’s highest-grossing mall in 2024. This gave Wakuku visibility at the heart of China's most premium retail real estate:

June 19 (Dragon Boat Festival): Wakuku's limited-edition launch drew long queues and a viral online moment. A 2.5-meter Wakuku mascot drew crowds, and #WAKUKU-related keywords exploded across Xiaohongshu and Weibo, with posts surpassing 500 million views and ranking #4 on Weibo's hot-search list.

Marketplaces sales data

Recent sales data from China’s leading e-commerce platforms suggest that Wakuku isn’t just trending—it’s selling. A lot.

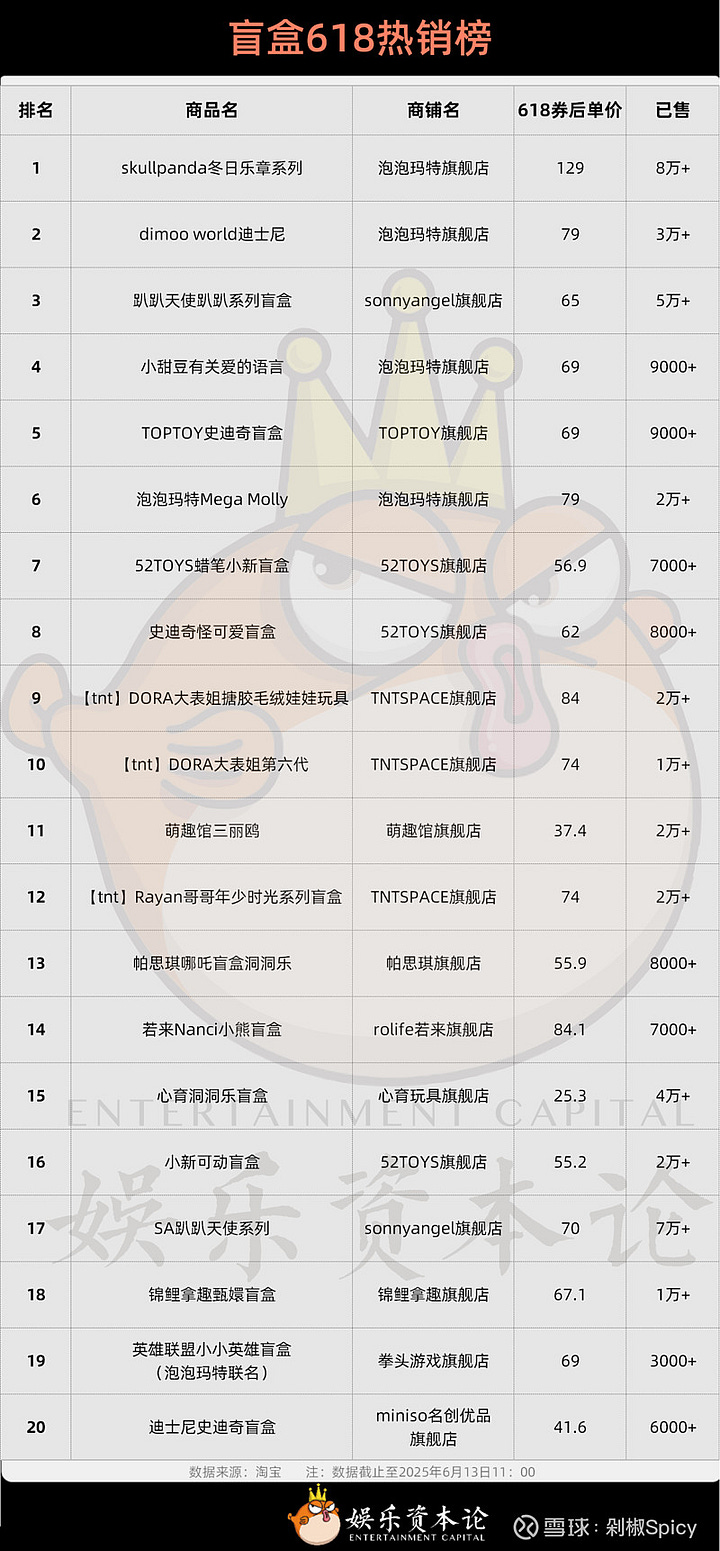

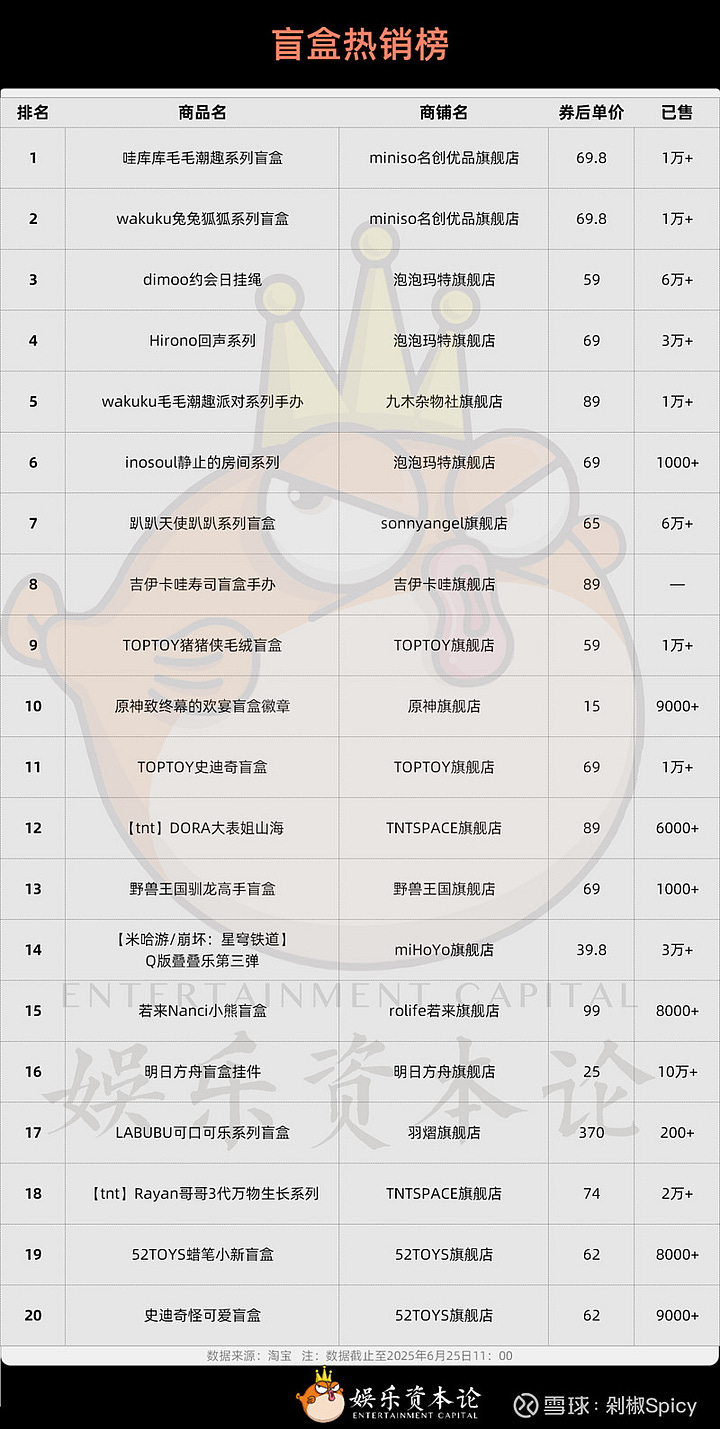

During and after the 2025 “618” mid-year shopping festival, we tracked a notable shift in rankings:

On June 13, Pop Mart was still dominant, with its flagship IPs Skullpanda and Dimoo holding the top spots on Taobao’s blind box charts.

But by June 25, Wakuku took over—claiming the top two positions on the same list.

And the momentum hasn’t slowed.

Wakuku is starting to displace Pop Mart in blind box rankings across multiple major platforms.

Summary of recent data

On Tmall, Wakuku’s Mao Mao Chao Qu series and Rabbit & Fox series ranked #1 and #2 on the blind box bestseller list.

As of June 24, Wakuku held the #1 spot on Tmall’s trending blind box list for 7 straight days.

On JD.com, Wakuku’s Mao Mao Fashion Party blind box ranked #4 overall, trailing only three Pop Mart series.

On JD.com, Wakuku ranks just behind Labubu, sitting at #6 with over 30,000 units sold.

Over 2,000 units of Wakuku's Mao Mao series were sold in just 15 days on Miniso’s JD flagship store.

**As of July 12th, the Wakuku blind boxes still occupy top-selling lists on Tmall and Doyuin:

Stocks to benefit

As you could observe, there are two intertwined beneficiaries of Wakuku trend.

QuantaSing

In early 2024, QuantaSing Group (NASDAQ: QSG) took a 61% stake in Letsvan for RMB 235 million, signaling its entry into China’s fast-growing cultural IP and designer toy market. The deal gives QSG full consolidation of Letsvan’s financials and IP portfolio.

Though best known as a senior-focused edtech platform, QuantaSing is pivoting toward emotional consumption and lifestyle IP. The Letsvan acquisition offers exposure to Gen Z-driven trends like blind boxes and collectible characters—but the strategy runs deeper.

China’s aging population—over 310 million people aged 60+—is increasingly turning to toys and cultural products for emotional connection and mental stimulation. With a strong foothold in online education for older adults, QSG is uniquely positioned to bridge generations, using Letsvan’s IP engine to develop new products that appeal across age groups.

This isn’t just a play on youth culture—it’s a long-term bet on cultural IP as a cross-generational asset class.

Financials

Its core edtech business is contracting—Q3 FY25 revenue fell 40% YoY to RMB570.7 million (~US$78.6 million)—but profitability improved: adjusted net income rose 18.5% YoY to RMB37.8 million (~US$5.2 million), even amid restructuring. This improvement reflects aggressive cost-cutting, reduced marketing spend, and a more selective, ROI-focused business mix.

The company remains cash-rich and debt-light, with RMB1.13 billion (~US$156 million) in cash and short-term investments and minimal leverage. Valuation remains modest: as of July 2025, QSG trades at a low-teens P/E on a trailing basis and closer to ~8–10x adjusted earnings if Wakuku’s contribution ramps as expected in FY26. Given the early-stage monetization of its consumer IP assets, the market has not yet re-rated QSG, suggesting potential upside if Wakuku sustains traction and QSG executes well on its consumer pivot.

Wakuku represents a valuable optionality that may not yet be fully priced into QSG’s stock. As the IP gains traction—and potentially scales globally through Miniso’s retail network—QSG could benefit from a new revenue stream beyond its core education business.

Miniso

Miniso (NYSE: MNSO | HKEX: 9896) is more than just a variety retailer—it’s one of China’s most important platforms for trendy toy retail, especially blind boxes. Over the past few years, Miniso has built a massive in-country toy retail network and expanded it’s portfolio of various IP toys.

But Miniso gains more than just sales margins. The viral popularity of Wakuku drives significant foot traffic and brand engagement to Miniso’s own stores, boosting basket sizes, impulse purchases, and visibility for its other IP products. As Miniso accelerates global expansion—particularly in Southeast Asia, the Middle East, and North America—Wakuku could become its next exportable hit, much like Pop Mart’s Labubu.

Risks to consider

Limited visibility outside of China

Wakuku's rise is unfolding primarily within Chinese social platforms and niche toy subcultures—ecosystems largely opaque to international investors. While there are early signals of international spillover (e.g., TikTok, Google trends), Wakuku’s brand equity is still overwhelmingly domestic. Plus, global scalability remains a long-term aspiration, not a near-term reality.

Low visibility within China

Despite being a Chinese-origin IP, QuantaSing Group (QSG) is listed solely on the U.S. Nasdaq exchange, which significantly limits participation from mainland Chinese investors—a key demographic that’s often closest to trends like Wakuku.

Adding to this, institutional coverage has been minimal until recently, meaning the stock has flown under the radar for many global investors as well. While a few analysts have begun initiating coverage, broader attention is still developing. This lack of market awareness may limit near-term valuation upside, even as the underlying brand gains traction.

Chinese crackdown on blind boxes

On June 20, shares of both Pop Mart and QuantaSing fell after Chinese state media called for tighter oversight of blind-box toys and trading cards. The commentary cited potential harm to minors and urged stricter controls, including:

"Platforms should implement triple verification: real-name authentication + face recognition + guardian verification. Sales to underage users who fail age checks should be prohibited. Offline stores should segregate ‘minors' areas’ and impose heavy penalties on violators."

This isn’t the first regulatory push targeting the blind-box space in China. While the core demographic skews Gen Z and millennial women, not children, investor sentiment can be sensitive to regulatory headlines.

Supply constraints and scalability gaps

Wakuku may be a victim of its own success. A telling comment from a Chinese netizen (source):

“After 618 ( shopping festival), I increased my position when I saw Wakuku’s livestream sales hit tens or even hundreds of thousands. But just a week later, the boxes slowly vanished from livestream shelves. The livestream host said it was due to low production capacity. Wakuku was more popular than expected.”

This reflects a key operational risk: Letsvan is still a small-scale player, and its production infrastructure may struggle to keep pace with viral demand. Compared to Pop Mart—which has scaled supply chains and in-house design teams—Wakuku's back-end still needs to mature. Missed sales due to stockouts could cap near-term upside and limit brand momentum.